Lendi - Product (Marketing & Acqusitions)

Company Lendi | Senior Product Designer Emma Mirabelle

Backstory

I joined Lendi not only because I was interested in Fintech, but also because of my own (painful) experience buying a property. What surprised me was not the process of finding the right property but seeking financing for it. I initially thought I'd apply directly with a lender but, after some research, I realised the benefits of applying with a mortgage broker to access loan products across their large lender panel. So I engaged a broker (along with 70% of the Australian market who go via a broker to get their home loan).

We met in person, I answered many questions and the brokers entered my answers into a program, which was then used to run calculations on my serviceability (slowly!). For me it was frustrating I couldn't enter the information myself, I had no visibility over how it worked, I didn't understand the reasons behind the questions and I just had to trust that the loan product recommendations would be the best ones. What I wanted was to have more control and visibility over the process so that I felt informed and confident about the biggest financial decision of my life.

My Lendi experience

Hence, when exploring moving beyond Consulting further into the Product world, I was excited to join Lendi, an established start-up that made it easier for customers to apply for a home loan through a customer-led digital application that ultimately matched you to a mortgage broker. I joined as the Senior Product Designer in the Marketing & Acqusitions team. This meant I was responsible for designing strategic acquisition journeys that would generate increased customer leads via digital channels.

During my time at Lendi, the business merged with Aussie Home loans, bringing on 1,000 additional mortgage brokers and catapulting Lendi into the largest distributor of home loans in Australia after the big four banks. Below are two examples of the projects I worked on during my time.

Project examples

Book an Appointment

This project aimed to make it easier for customers to book an appointment with a broker and for brokers to plan for appointments. The key problems we wanted to fix were:

- Better utilise brokers time

We beleived we could achieve this by reducing no shows and ensuring gaps between appointment slot times. For context, 30% of customers cancelled appointments last minute. By creating a digital cancellation and reschedule flow (as opposed to manually calling Lendi's call centre), we believed we could reduce unexpected missed appointments since customers could easily cancel via a couple of clicks. Also, some brokers told us that they would often have back to back appointments with no time to write notes after the call or take a short break, which led us to adding logic that appointments needed to have at least a 10 minute gap between available slots. - Better qualify leads

We wanted to ensure only 'high intent' users were matched directly with experienced brokers, while those who were 'lower intent' (e.g. still in their Discovery/Research phase or needed to save more capital for a deposit) would be paired with a less specialised staff member. This also involved better understanding customer loan preferences to match them with the right specialist broker e.g. a broker who could help with guarantor loans, SMSF loans, loans for Companies and Trusts, etc. - Increase customer booking completion rates

We wanted to reduce dropoffs by minimising friction within the existing appointment booking experience and therefore increase the number of completed bookings. This involved critically evaluating the current user journey, reviewing the user data and assessing what questions were necessary and in which order should they appear.

Product challenge scenario

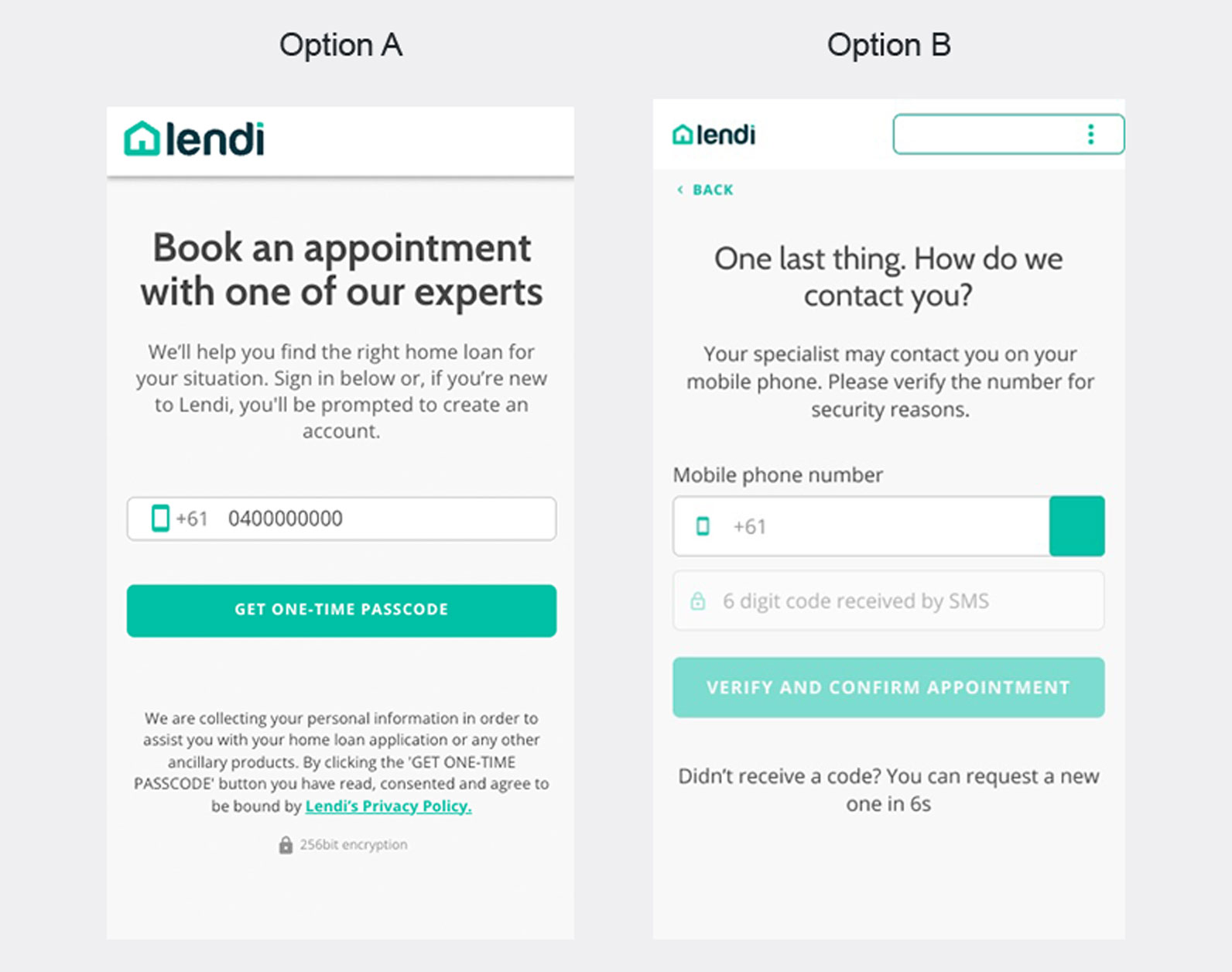

One of the biggest challenges for the Book an Appointment (BaA) project was deciding when to ask the user for their contact information: to ask it as the first step (Option A), or the last step (Option B).

Option A

- Pro: If the client drops off during the user flow the broker can still contact them and attempt to convert them.

- Pro: Caters well for returning users because they can login imediately via their mobile number, which unlocks their existing data with Lendi including previous home loan enquiries and broker relationships. For example, if they'd been talking to a broker previously, we could connect them back with that same broker without the need to ask further questions.

- Con: Does not cater well for new users given data showed that a signficiant number of them were starting and dropping off as soon as they had to provide their phone number. My hypothesis was that customers didn't have enough buy-in to hand over such personal data immediately - it's like asking someone on a date, it helps to get to know them first!

Option B

- Pro: Avoids new user bounce rates due to the perceived high initial barrier (providing their mobile) to start

- Pro: Allows Lendi to demonstrate value (through a seamless booking experience) before requiring something in return.

- Con: No way to contact the user should they drop-off during the flow.

- Con: Doesn't allow Lendi to personalise and fast-track the process using existing data from return users.

Decision time

To work out what to do we dug into the data. Were most customers Return Customers or New Customers? But is it just volume we care about? What about the value placed on new leads vs. existing? Do we want less volume but higher intent leads or more volume but lower intent? (Our hypothesis was that the higher the intent the more likely they'd provide their phone number). How frustrating would it be as a Return Customer to have to put in some of the same information again? Could we design a separate flow for Return Customers? (Another problem was that some customers didn't remember that they'd previously created an account - they thought they were a New Customer when in fact they were a Return Customer).

After further investigation and weighing up pros and cons, we went with Option A. Our research indicated that it was likely the users who were deterred from entering their phone number were lower intent and the benefits of capturing this information up front to provide a personalised experienced to existing users plus be able to contact new users if they dropped off during the journey, outweighed the drop off rate initially.

What I learned?

Often the right option is the lesser of two evils and dependant on what the business objectives are at that time. While speaking to customers and running A/B tests can help with testing hypotheses to inform decisions, it is not always feasible or necessary (given cost and time impacts).

In this case, even if we had run an A/B test, we found that multiple projects carrying out feature releases in parallel made it hard to obtain conclusive results from an A/B test given we would be unable to isolate the results to our own team's feature. Thankfully for us, after some weeks of tracking this feature post implementation, we found that this decision, along with our other BaA updates mentioned above, led to an increase in bookings by 25% each day. We had positive feedback from brokers and customers alike.

Website replatforming, rebranding and redesign

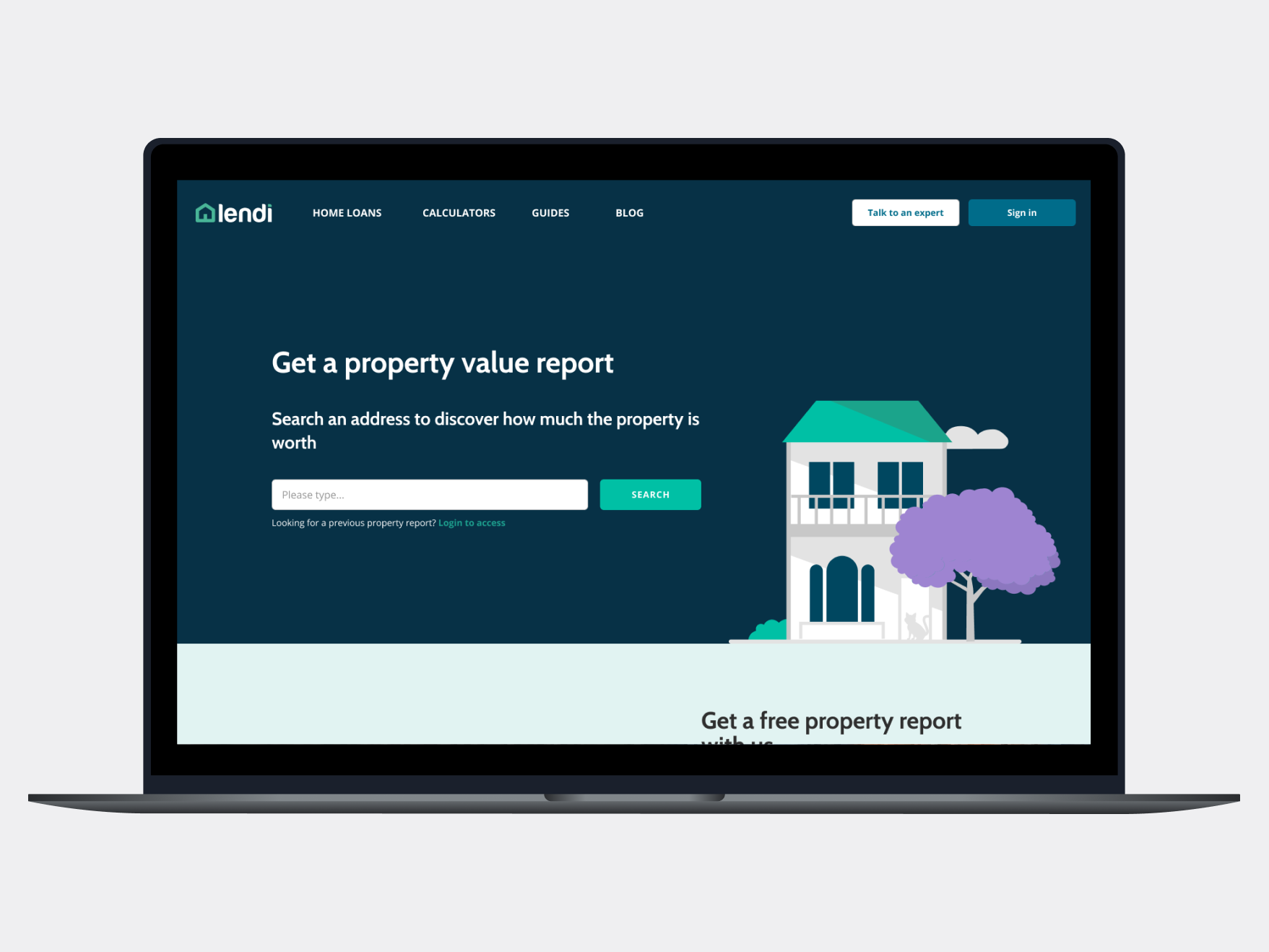

This project aimed to improve our public website and branding due to a larger strategic objective of migrating from the "Old world" tech architecture to the "New world". Specifically this involved:

- CMS replatforming including new page templates, components and content migration

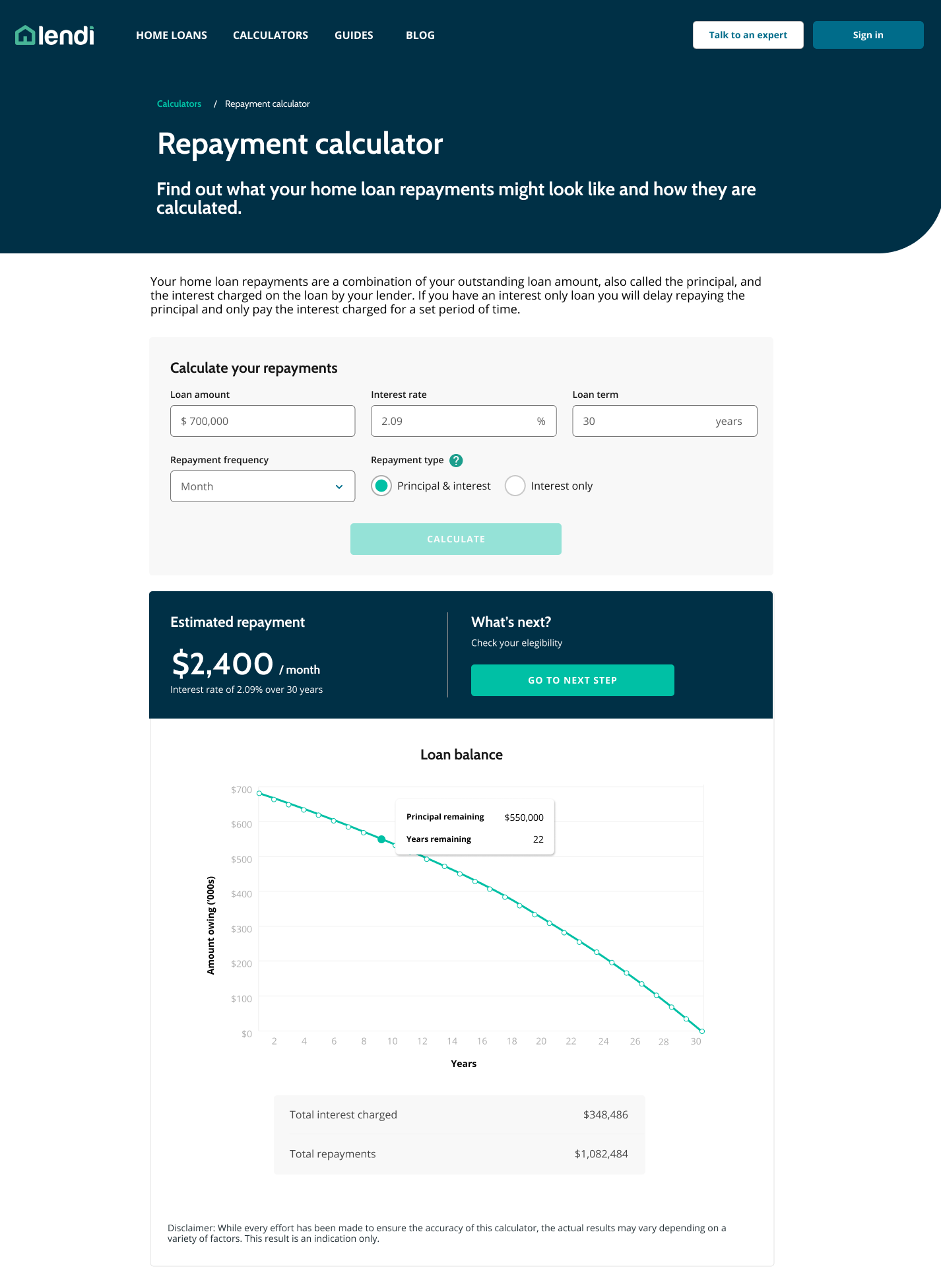

I worked closely with the Front-end developers and the Marketing team to create new page templates and components that could be used by Marketing when authoring new content. By creating consistency in page designs based on the page's level in the Information Architecture as well as re-usable responsive components, we were able to make information easier to navigate across the website for end-users and also dramatically increase speed to production for Marketing. Their content authoring process no longer involved engaging front-end developers for small tweaks, instead they were empowered to work more autonomously and efficiently. The new CMS also seamlessly integrated with the New World platform architecture, all of which resulted in further streamlining the business. - Redesigning key customer facing home loan calculators

Digital calculators are key acquisition tools for Lendi given users in the early stage of their home loan journey are often seeking to better understand such questions as: "How much can I borrow?", "How much would I save with an Offset account?", "How much Stamp Duty do I need to pay?" and "What will my repayments be?". Creating well designed calculators meant that we could give customers estimated costs, serving their initial needs and then prompting them to take the next steps with Lendi. This piece of work involved reviewing existing calculators and strategically improving them based on user data and SME interviews so that we could optimise results and increase users clicking through to their 'next best action'. - Re-branding from generic stock images to illustrations I worked with Marketing to lead the creative brief of Lendi brand illustrations, including oversight of the Creative Agency’s design iterations. This work involved heavy engagement of key stakeholders to align on Lendi's brand vision and bringing this to life with the Creative team. We wanted to move away from Stock photos of houses and towards playful illustrations with personality that showcased the world through the customer's eyes. The goal was to better differentiate Lendi and communicate what Lendi does in a clear, customised way.

- Improving SEO Improving or at least maintaining our search enginge rankings was critical to our success in CMS re-platforming. Lendi was appearing prominently in search results for common queries by people early in their home loan journey. Our goal was to maintain these rankings or improve upon them. This included rankings for the home page, the blog, calculators and more. After analysing such items as our page load times, key words, sitemap, meta tags etc., we found that with some code refactoring, file size reduction and more targeted tailoring of key words based on updated search data, we were able to not only maintain but also improve overall rankings in Google search results.

Rebranding

Website homepage redesign

Calculator redesign